Annual Reports

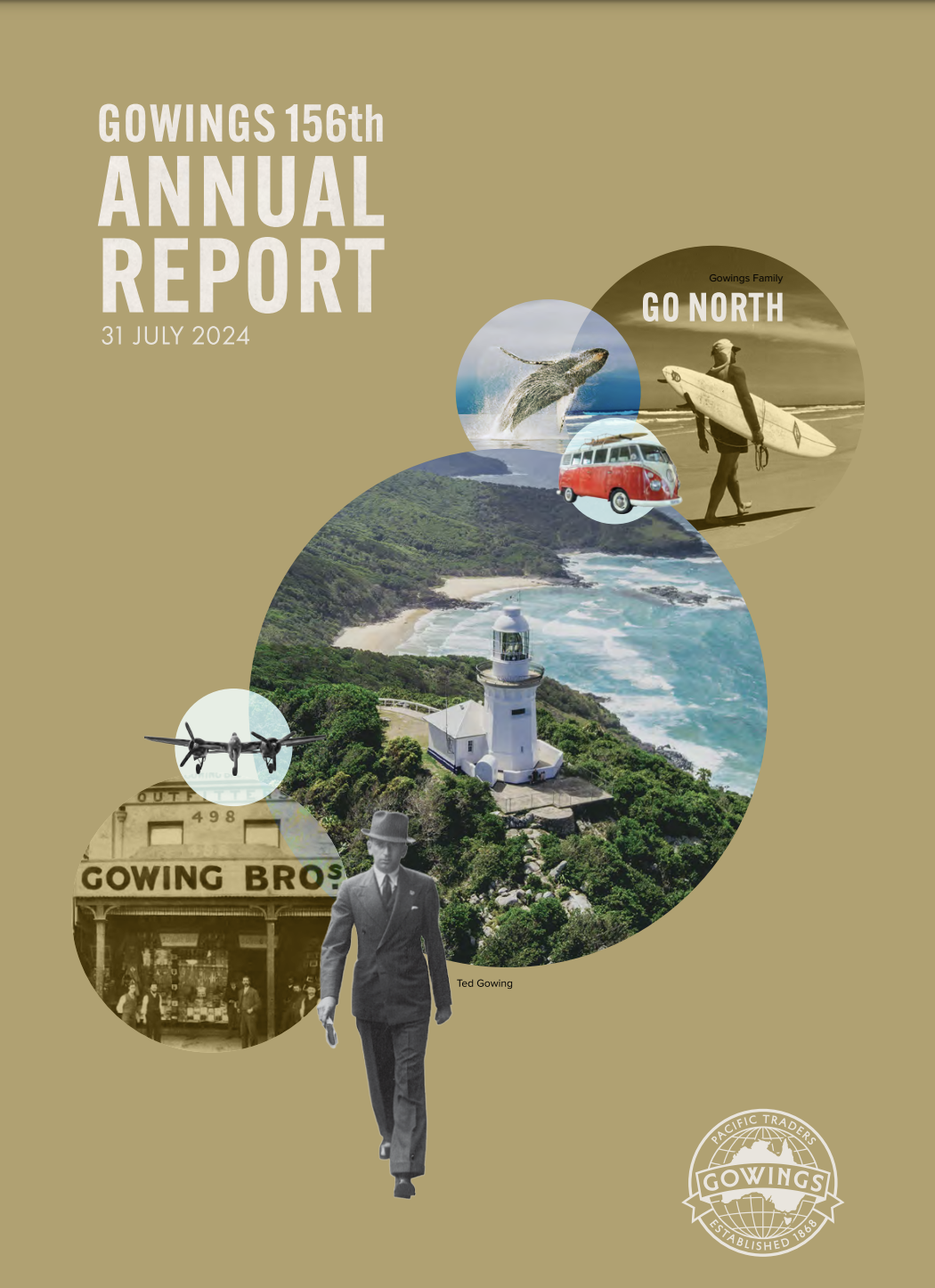

2024 Annual Report

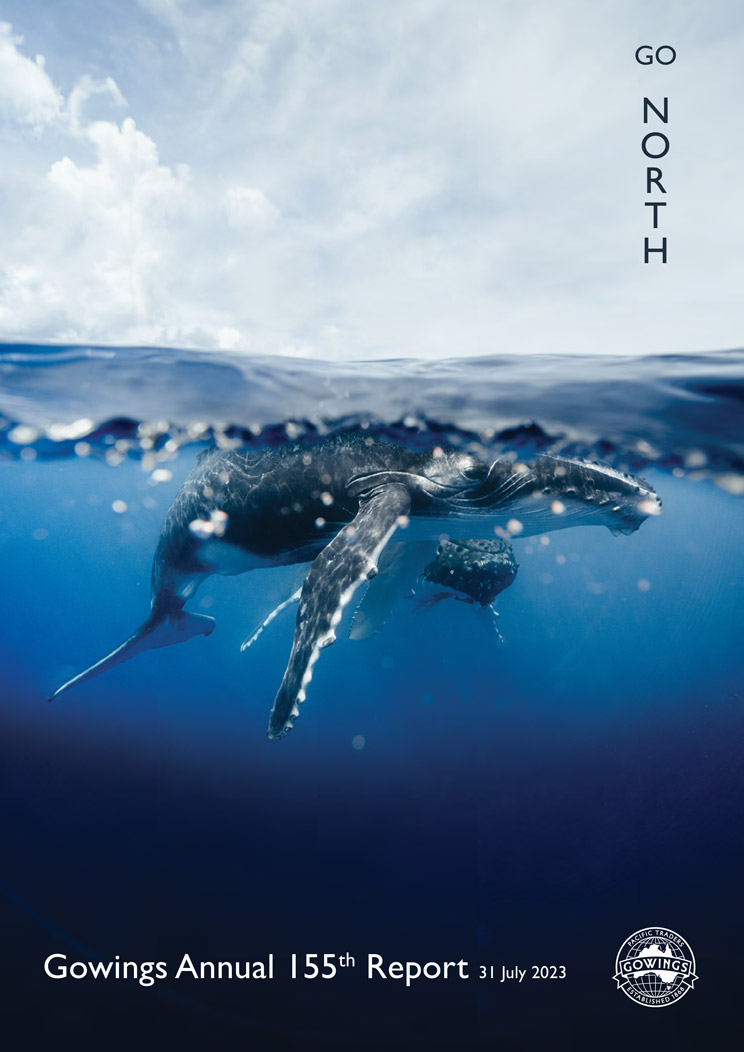

2023 Annual Report

2022 Annual Report

2021 Annual Report

2020 Annual Report

2019 Annual Report

2018 Annual Report

2017 Annual Report

2016 Annual Report

2015 Annual Report

2014 Annual Report

2013 Annual Report

2012 Annual Report

2011 Annual Report

2010 Annual Report

2009 Annual Report

2008 Annual Report

2007 Annual Report

2006 Annual Report

2005 Annual Report

2004 Annual Report

2003 Annual Report

2002 Annual Report

INVESTMENT SPOTLIGHT

SYMBYX Biome

SYMBYX Pty Ltd is an Australian medical technology company developing Photobiomodulation (PBM) or cold laser therapies to manage previously intractable, chronic diseases and inflammatory conditions. The primary treatment route is via the gut microbiome, leveraging the increasingly well-researched linkages between the microbiome and various body systems, including the nervous system, heart, and kidneys. Parkinson’s and Fibromyalgia are current p...

SYMBYX Biome

INVESTMENT SPOTLIGHT

Best & Less Group

Best & Less Group, made up of the brands Best & Less in Australia and Postie in New Zealand, is a retailer specialising in baby and kids’ apparel. The company generates 86% of revenue from its proprietary brands, all designed in-house. Its clothing is then distributed for sale across 246 physical stores and online. The group recorded unaudited sales revenue of $663 million for FY21. The group listed on the ASX on July 26th af...

Best & Less Group

INVESTMENT SPOTLIGHT

CannaPacific

CannaPacific is an Australian biotechnology company with a focus on developing novel registered cannabinoid-based medicines for patients with unmet medical needs. CannaPacific is building a global therapeutic offering with an initial focus on palliative care and post-traumatic stress disorder. Their 3 core business hubs are Pharma Development (rebranded to 3eD Pharma); Cultivation and Clinical engagement programs. During FY 21 their Pharma stra...

CannaPacific

INVESTMENT SPOTLIGHT

National Stock Exchange of Australia Limited

NSX owns and operates the National Stock Exchange of Australia; the second largest listings exchange in Australia. NSX is building an alternative exchange, creating a deeper, more liquid and a lower cost of raising capital. Gowings believes NSX has the potential to develop into a Tier 1 listings exchange, providing strong growth by initially targeting lower market capitalisation companies and providing exchange services at lower cost. In May 2021...

National Stock Exchange of Australia Limited

INVESTMENT SPOTLIGHT

Cobram Estate Olives

Cobram Estate Olives is Australia's leading producer of premium extra virgin olive oil and Australia’s largest olive farmer. Boundary Bend produces Australia’s two top selling extra virgin olive oil brands, Cobram Estate and Red Island, and owns 2.4 million producing trees on over 6,575 hectares of pristine Australian farmland located in the Murray Valley region of northwest Victoria. Additionally, Boundary Bend operates a bottling, storage a...

Cobram Estate Olives

INVESTMENT SPOTLIGHT

Five V Capital

Five V Capital was set up and is managed by Adrian MacKenzie and Srdjan Dangubic, experienced Australian private equity and venture capital managers with whom Gowings has enjoyed a long relationship. Gowings have committed $1 million to Five V’s Fund II which has invested in leading businesses across a range of sectors including healthcare, retail, media, consumer, technology, and financial services. Including brands such as Madman Entertainmen...

Five V Capital

INVESTMENT SPOTLIGHT

Our Innovation Fund

Our Innovation Fund is an early-stage venture capital fund that invests in Australian-based, early-stage, innovative technology businesses with the potential for high growth and attractive returns. The Fund is run by a team with decades of experience investing in and building technology businesses. The fund capitalises on the Australian Government's National Innovation and Science Agenda, seeking to stimulate the Australian innovation ecosystem w...

Our Innovation Fund

INVESTMENT SPOTLIGHT

Carlton Investments

Carlton Investments Limited is a listed investment company, incorporated in 1928 and traded on the ASX. Carlton Investments’ strategy is to invest in established, well managed Australian listed entities that are expected to provide attractive levels of franked dividends and long-term capital growth. Investments are held for the long term and are generally only disposed of through takeover, mergers or other exceptional circumstances that may ari...

Carlton Investments

INVESTMENT SPOTLIGHT

DiCE Molecules

DiCE Molecules (DiCE) is a privately held US biotechnology company running a technology platform that began at Stanford University and has the potential to revolutionize small molecule drug discovery. Their business model includes the generation of milestone payments and royalty revenue through drug discovery collaborations, alongside the monetization of its own drug development assets.

DiCE has been making great progress despite COVI...

DiCE Molecules

INVESTMENT SPOTLIGHT

PowerPollen Accelerated Ag Technologies

PowerPollen is an early-stage agricultural technology company based in Iowa, USA, that is working on advanced yield enhancement technology that enables higher yields in seed and grain production. PowerPollen has created a paradigm shift in agriculture by revolutionizing how plants reproduce, providing unprecedented control of pollination that simplifies corn seed production while potentially enabling hybrid production and higher profits in curren...

PowerPollen Accelerated Ag Technologies

INVESTMENT SPOTLIGHT

Pacific Coast Shopping Centres

Our centres are well placed and continue to capitalise from the rapid economic growth and development currently being experienced in the NSW Mid North Coast region. Substantial ongoing government investment including the approved $1.8 billion dollar Coffs Harbour Pacific Highway Bypass Project due to commence later in 2021, combined with a large population surge due to increased work flexibility and other infrastructure investment including healt...

Pacific Coast Shopping Centres

INVESTMENT SPOTLIGHT

Coffs Central Shopping Centre

During the period the leasing team were able to successfully renew a major anchor tenant and secure high-quality new retailers in the more challenging air-bridge space at rental levels above valuation including:

Hearing Australia, Shape 20, Fone Works

The leasing pipeline and enquiry levels remains relatively strong with 3 new lease deals and 7 renewals currently being negotiated. The team is taking a highly selective ap...

Coffs Central Shopping Centre

INVESTMENT SPOTLIGHT

Port Central Shopping Centre

Port Central continues to trade strongly and vacancies are at a minimum. During the period we secured BCU in a prominent street-facing site and we are negotiating lease deals with 3 new tenants. The renewals pipeline is strong with a major fashion offer renewing during the period and 10 renewals relating to major retail groups close to finalisation.

The planned capital upgrade & reconfiguration of the upstairs food court in...

Port Central Shopping Centre

INVESTMENT SPOTLIGHT

Kempsey Central Shopping Centre

We are very pleased to report that the Country Universities Centre Macleay Valley (which was backed and supported by the Federal & NSW Government, CUC Central, Kempsey Shire Council, and Gowings Bros Ltd was opened officially at Kempsey Central in April 2021 by the Mayor and local Federal member. CUC is a major strategic tenancy for the centre and has been hugely successful since its launch with 114 registered students, far exceeding the init...

Kempsey Central Shopping Centre

INVESTMENT SPOTLIGHT

Sawtell Commons

Completion of the Stage 2 works sees 20 of the 220 Sawtell Commons residential lots constructed and registered for sale or development. Sale prices for the stage 3 release of 56 lots are being reviewed but to date, pre-sale interest has been strong with 11 holding deposits received at an average of $325,000 per lot. Stage 3 subdivision works have commenced with Registration for stage 3 expected around the end of March 2022....

Sawtell Commons

INVESTMENT SPOTLIGHT

Solitary 30

The Jetty development site located at 357 Harbour Drive paves the way for an exciting new mixed-use development for Gowings. The site has now been demolished and some of the historic and original timber elements of the Forestry Building have been re-purposed at the new Gowings Head Office located on level 3 of the Gowings Building on Harbour Drive in Coffs Harbour. Various Architects have presented several concepts for the site and are we contin...